- Article

- Long-Term Financing

- Enable Growth

Benefits of Supply Chain Finance for Malaysian Companies

Trade remains the bedrock of the global economy; despite prevailing recessionary concerns and the risks around deglobalisation. Key priorities amongst corporates in Asia (including Malaysia) and around the world, would be to ensure resilience and adaptability in their supply chain where cost effective and efficiently managed trade networks are crucial to achieve commercial success in an uncertain environment. For these reasons organisations are looking to understand how supply chains have changed and what they need to prepare for the period ahead.

In researching for the “Global Supply Chains – Networks of Tomorrow” report, HSBC teamed up with East and Partners to understand global supply chains and the future of supply chain financing and sustainability. HSBC has based this report on primary research conducted by East and Partners between August and October 2022, directly interviewing senior management from 787 corporations across 14 markets in Asia Pacific (including Malaysia), Europe, North America, Latin America, and the Middle East, to gather direct feedback about how they are managing their supply chains and interacting with their suppliers. Details of the report can be found in “Global Supply Chains – Networks of Tomorrow | HSBC”. Key takeaways from this report can be summarised below:

As a top-25 trading nation and a key part of the global supply chain, it is imperative that Malaysian companies continuously evaluate their supply chain solutions so that they are prepared for any adverse changes in global economic conditions.

|

Within this article, we will explore supply chain finance and explain how it can benefit Malaysian companies.

What is Supply Chain Finance (SCF)?

Broadly, SCF may refer to financing of trade activities throughout a supply chain. From HSBC’s perspective, SCF proposition is a working capital solution which provides a form of supplier financing premised on the potential credit arbitrage that may exist between the buyer and its suppliers. This proposition is ‘buyer-centric’ in that the buyer is HSBC's customer, who arranges a programme in favour of its suppliers that has the option of receiving the discounted value of an approved invoice prior to its actual due date. SCF is the accepted standard market name for this proposition however, synonyms that are widely used by customers and other banks would include Payables Finance, Reverse Factoring or Supplier Finance.

Supply Chain Finance Process: How does it work?

The key elements required for a Supply Chain Finance proposition are:

- Buyer purchases from suppliers on open account with trade credit terms

- Buyer identifies invoices for which they instruct HSBC to pay by the invoice due date premised on its irrevocable commitment to pay the approved invoice

- HSBC makes early payment to suppliers on a fully non-recourse basis

- Financing charge is driven by the buyer’s cost of credit

Illustrations below are examples of how SCF transaction flow released the economic value for both buyer and supplier.

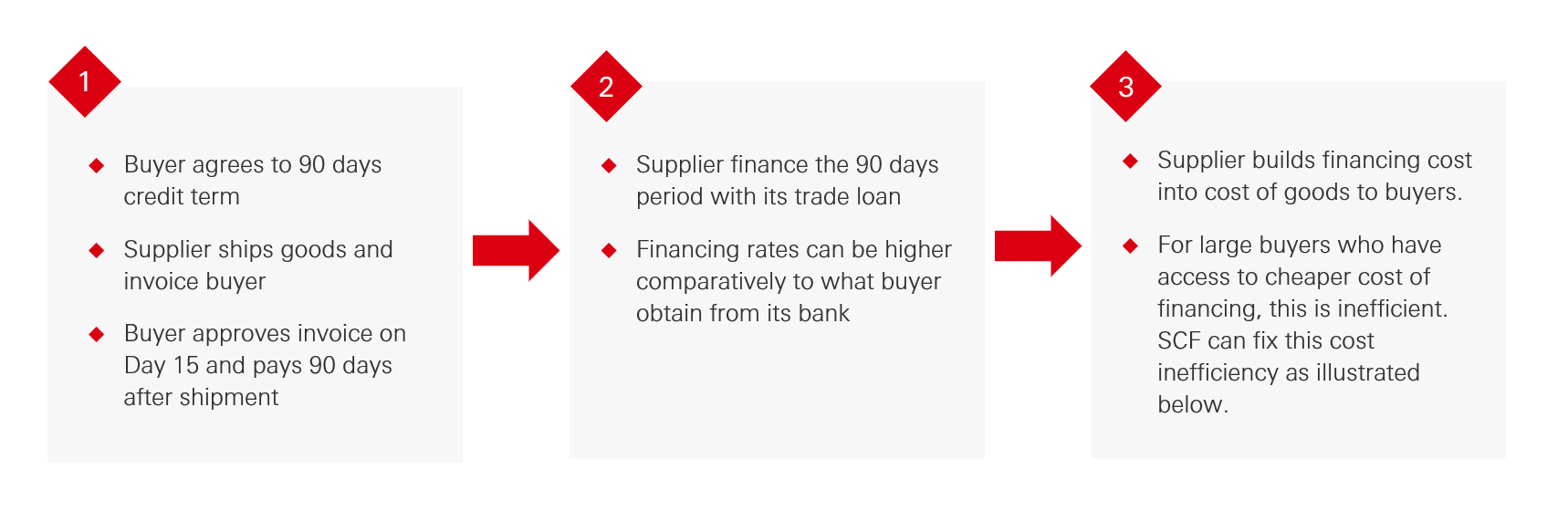

Scenario 1 - A typical example of buyer-supplier transaction flow

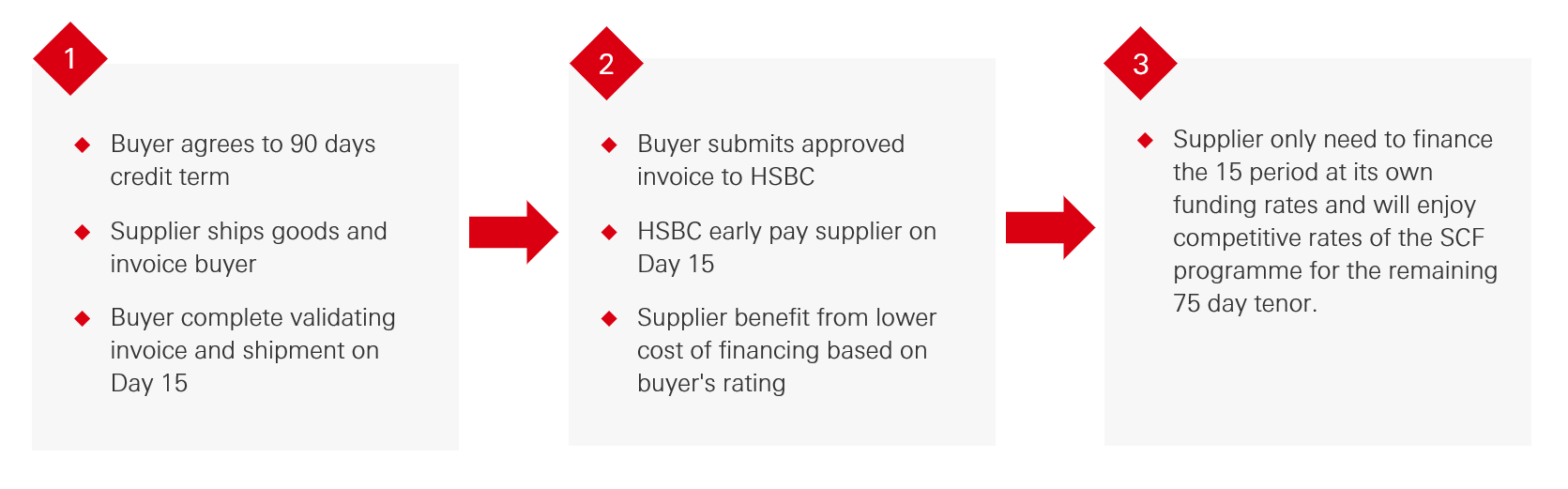

Scenario 2 - A Supply Chain Finance transaction flow

Deriving Economic Value

The most common way for the buyer to share this economic value with the supplier is to agree on improved payment terms with the supplier in line with the relevant industry norms. In this example, the buyer can extend the terms to 105 days. The supplier will only have to finance the invoice-approval period at its own funding rates (15 days), but it will enjoy the competitive rates of the HSBC SCF programme for the rest of the tenor (90 days, from day 15 to day 105).

This allows the buyer to keep cash longer. Although payment terms are agreed at a longer tenor, the solution provides significant savings to the supplier if the cost of financing is lower than the supplier’s own rate. This gives suppliers the ability to manage longer payment terms.

Potential Benefits of Supply Chain Finance

SCF can place buyers and suppliers in a better position after adopting the programme. The potential benefits below illustrates how SCF may fulfil organisations’ needs to ensure resilience and adaptability in their supply chain to operate with optimum efficiencies.

“Corporates are thinking about their supply chains as holistic ecosystems and collaborating with their suppliers to structure the most optimal financing solutions across the entire supply chain. They are cultivating deeper strategic relationships with a smaller set of suppliers as they reconfigure their supply chains and amplify their sustainability objectives.”

- Vinay Mendonca Chief Growth Officer, Global Trade and Receivables Finance, HSBC

HSBC's Supply Chain Finance Solutions

The unique selling points and distinctive features of HSBC’s Supply Chain Finance proposition (be it conventional or Amanah) makes it easy for suppliers to join. With a few simple steps and minimum documentation, suppliers may quickly start receiving early payments for their approved invoices.

HSBC’s extensive global network provides the programme with more local HSBC staff to engage with suppliers in the local language, culturally aligned, in person with the prospect to provide translated material. Our structuring expertise and dedicated programme managers are committed to ensuring the success of the programme during its lifetime.

HSBC’s Supply Chain Finance platform enables cost savings by streamlining procure-to-pay and order-to-cash processes for both buyers and suppliers - unifying suppliers’ payments under a single model, develops straight through process characteristics from a treasury perspective and allowing auto-debit payments at maturity, hence reducing the payment-processing costs for buyers. Buyers may take advantage of HSBC’s SCF Dynamic Discounting feature, providing buyers with the opportunity to use their excess cash to self-fund early payments to suppliers.

More importantly, HSBC is well positioned to help customers meet their sustainable objectives via its Sustainable SCF, a proposition which integrates Environmental, Social and Governance (ESG) considerations into the programme by linking supplier early payment charge to suppliers’ sustainability credentials.

Through its extensive network in Malaysia and beyond, HSBC provides convenient access to international markets as well as local expertise that is tailored to each customer’s unique requirements. From helping companies manage payments more effectively to reducing risk through better data visibility into orders placed and invoices paid throughout the entire process— HSBC is committed to providing reliable solutions that will enable Malaysian businesses to remain competitive in today's global economy.